Copay: Some services require that you pay a copay. A copay is a flat dollar amount, like $25 for a doctor's visit. Network: A group of doctors, hospitals, facilities and other healthcare providers contracted with a health insurance carrier to provide services to plan members for set fees. Out-of-Pocket Maximum.

- Procedures covered by the plan and the amount you will pay the dentist (your copays). These copays apply only when you receive treatment from the dentists or dental specialists in our Cigna Dental Care DHMO Network. If a dental procedure is not listed on your PCS, it is not covered and you will have to pay according to the dentist’s regular fees.

- Health Plan One offers more than 100 health insurance plans in Nashville, which is part of Davidson County, Tennessee. Health insurance carriers that offer individual and family health insurance plans in Nashville include Aetna, BCBS, Cigna, Golden Rule, and Humana.

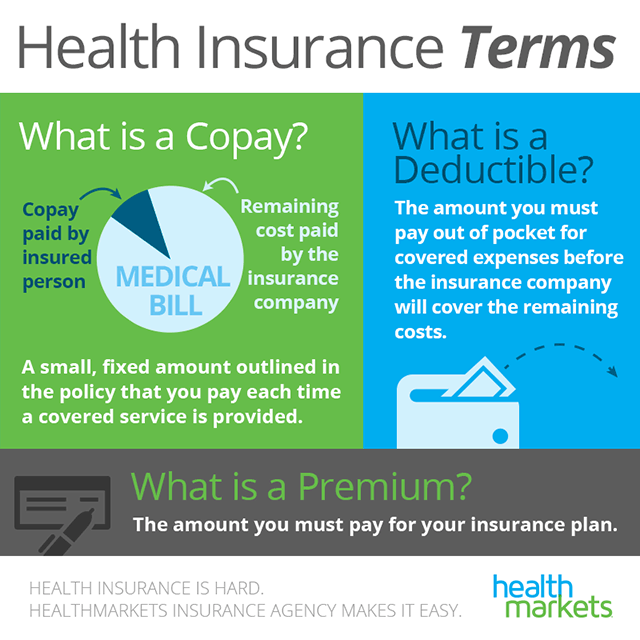

A copayment or copay is a fixed amount for a covered service, paid by a patient to the provider of service before receiving the service. It may be defined in an insurance policy and paid by an insured person each time a medical service is accessed. It is technically a form of coinsurance, but is defined differently in health insurance where a coinsurance is a percentage payment after the deductible up to a certain limit. It must be paid before any policy benefit is payable by an insurance company. Copayments do not usually contribute towards any policy out-of-pocket maxima whereas coinsurance payments do.[1]

Insurance companies use copayments to share health care costs to prevent moral hazard. It may be a small portion of the actual cost of the medical service but is meant to deter people from seeking medical care that may not be necessary (e.g., an infection by the common cold). In health systems with prices below the market clearing level in which waiting lists act as rationing tools,[2] copayment can serve to reduce the welfare cost of waiting lists.[3]

However, a copay may also discourage people from seeking necessary medical care and higher copays may result in non-use of essential medical services and prescriptions, thus rendering someone who is insured effectively uninsured because they are unable to pay higher copays. Thus, there is a balance to be achieved: a high enough copay to deter unneeded expenses but low enough to not render the insurance useless.[editorializing]

Germany[edit]

The German healthcare system had introduced copayments in the late 1990s in an attempt to prevent overutilization and control costs. For example, Techniker Krankenkasse-insured members above 18 years pay the copayments costs for some medicines, therapeutic measures and appliances such as physiotherapy and hearing aids up to the limit of 2% of the family's annual gross income. For chronically ill patients, the co-payment limit is 1% including any dependant living in their home. The average length of hospital stay in Germany has decreased in recent years from 14 days to 9 days, still considerably longer than average stays in the U.S. (5 to 6 days).[4][5] The difference is partly driven by the fact that hospital reimbursement is chiefly a function of the number of hospital days as opposed to procedures or the patient's diagnosis. Drug costs have increased substantially, rising nearly 60% from 1991 through 2005. Despite attempts to contain costs, overall health care expenditures rose to 10.7% of GDP in 2005, comparable to other western European nations, but substantially less than that spent in the U.S. (nearly 16% of GDP).[6] However, after research studies by the Forschungsinstitut zur Zukunft der Arbeit (Research Institute for the Future of Labor) showed the copayment system was ineffective in reducing doctor visits, it was voted out by the Bundestag in 2012.

Prescription drugs[edit]

Some insurance companies set the copay percentage for non-generic drugs higher than for generic drugs. Occasionally if a non-generic drug is reduced in price insurers will agree to classify it as generic for copayment purposes (as occurred with simvastatin). Pharmaceutical companies have a very long term (frequently 20 years or longer) lock on a drug as a brand name drug which for patent reasons cannot be produced as a generic drug. However, much of this time is exhausted during pre-clinical and clinical research.[7]

To cushion the high copay costs of brand name drugs, some pharmaceutical companies offer drug coupons or temporary subsidized copayment reduction programs lasting from two months to twelve months. Thereafter, if a patient is still taking the brand name medication, the pharmaceutical companies might remove the option and require full payments. If no similar drug is available, the patient is 'locked in' to either using the drug with the high copays, or a patient takes no drugs and lives with the consequences of non-treatment.

Observed effects[edit]

Medication copayments have also been associated with reduced use of necessary and appropriate medications for chronic conditions such as chronic heart failure,[8]chronic obstructive pulmonary disease, breast cancer,[9] and asthma.[10] In a 2007 meta-analysis, RAND researchers concluded that higher copayments were associated with lower rates of drug treatment, worse adherence among existing users, and more frequent discontinuation of therapy.[11]

See also[edit]

Notes[edit]

- ^University of Puget Sound. Benefits update. 2006 medical plan frequently asked questions. What is the difference between co-payments, coinsurance, and deductibles? Retrieved November 10, 2008.

- ^Lindsay, Cotton M. and Bernard Feigenbaum (1984) 'Rationing by waiting lists', American Economic Review 74(3): 404-17.

- ^Diego Varela and Anca Timofte (2011), 'The social cost of hospital waiting lists and the case for copayment: Evidence from Galicia'Archived 2015-11-07 at the Wayback Machine, The USV Annals of Economics and Public Administration 11(1): 18-26.

- ^'Germany: Health reform triggers sharp drop in number of hospitals'. Allianz. 25 July 2005. Retrieved November 14, 2011.CS1 maint: discouraged parameter (link)

- ^'Average Length of Hospital Stay, by Diagnostic Category – United States, 2003'. Centers for Disease Control and Prevention. Retrieved November 14, 2011.CS1 maint: discouraged parameter (link)

- ^Borger C, Smith S, Truffer C, et al. (2006). 'Health spending projections through 2015: changes on the horizon'. Health Aff (Millwood). 25 (2): w61–73. doi:10.1377/hlthaff.25.w61. PMID16495287.

- ^Schacht, Wendy H. and Thomas, John R. Patent Law and Its Application to thePharmaceutical Industry: An Examination of the Drug Price Competition and Patent Term Restoration Act of 1984('The Hatch-Waxman Act')[1] Retrieved December 1, 2014.

- ^Cole JA, et al. Drug copayment and adherence in chronic heart failure: effect on cost and outcomes.[permanent dead link] Pharmacotherapy 2006;26:1157-64.

- ^Neugut AI, Subar M, Wilde ET, Stratton S, Brouse CH, Hillyer GC, Grann VR, Hershman DL (May 2011). 'Association Between Prescription Co-Payment Amount and Compliance With Adjuvant Hormonal Therapy in Women With Early-Stage Breast Cancer'. J Clin Oncol. 29 (18): 2534–42. doi:10.1200/JCO.2010.33.3179. PMC3138633. PMID21606426.[permanent dead link]

- ^Dormuth CR, et al. Impact of two sequential drug cost-sharing policies on the use of inhaled medications in older patients with chronic obstructive pulmonary disease or asthma. Clin Ther 2006;28:964-78; discussion 962-3.

- ^Goldman DP, Joyce GF, Zheng Y. Prescription drug cost sharing: associations with medication and medical utilization and spending and health. JAMA 2007;298:61-69.

As Health Savings Accounts have become quite popular, many people are asking, “What’s the difference between a traditional insurance plan and an HSA-based plan?” Both plans offer valuable insurance coverage to protect you from high-cost medical expenses, and yet there are some key differences. So let’s examine their core distinctions, the advantages and disadvantages, and the cost over time.

On a traditional “co-pay plan” you and your employer pay a monthly premium to cover the cost of your health insurance. Then, when you go to the doctor or pick up a prescription, you pay a fixed cost called a “co-pay” and the insurance company generally covers the rest. Co-pay plans also have a deductible. Once you’ve met your deductible you also have a co-insurance phase with cost-sharing between you and your provider on high-cost medical expenses before you meet your max out-of-pocket. Once you’ve met your max out-of-pocket, insurance will then generally cover the balance. And, most all preventive services are typically covered 100%. Just check with your plan for those details.

A typical co-pay plan look something like this:

- $25 co-pay for an office visit

- $10 co-pay for generic prescription drugs

- $50 co-pay for brand name prescription drugs

Your deductible could be anywhere from $500 to $2,000, but for this example, let’s use $500 for the deductible.

- 80% co-insurance (you pay 20%)

- $3,000 out-of-pocket maximum

To put a number out there, let’s say that you and your employer pay $6,000 a year, or $500 per month for this plan. Keep in mind, this number will vary based on several factors.

How To Calculate Copay

Now let’s talk about HSA based plans.

With an HSA based plan, you often pay a lower premium in return for having a higher deductible. The key difference is that an HSA-based plan has two parts: Insurance PLUS a health savings account. Your HSA is a personal tax-free health savings account that can be used to pay for eligible medical expenses. Usage of your HSA funds may also count toward your deductible and coinsurance amounts. And, remember, like any other insurance plan you pay nothing for preventative care like annual check-ups.

Just like a co-pay plan, in an HSA based plan, you would still have a deductible, co-insurance and an out of pocket maximum. Since your deductible is higher in an HSA based plan, you and your employer will save money….le’t say that by moving to a $1,500 deductible, you and your employer now pay $5,000 a year instead of the $6,000 a year in the co-pay plan. If that $1,000 is put into your HSA, your HSA plan could look like this:

- $1,000 tax-free annual contribution into your HSA

- $1,500 deductible

- 80% co-insurance

- $3,000 out-of-pocket maximum

- $400 monthly premium

Let’s consider an example of how these plans actually work side-by-side.

Let’s say you’re changing a lightbulb and take a nasty fall—It happens, and nobody plans on a painful, broken wrist! After a trip to the Emergency Room, surgery and perhaps some physical therapy, you are feeling a bit better.

But you now have a $10,000 medical bill to cover the services.

In a traditional co-pay plan with a deductible of $500, you pay a co-pay for the ER (say $100), then you would need to pay $500 to meet your deductible. Finally, you would need to pay your portion of co-insurance which is 20% of the remaining $9,500 or $1,900. Then the insurance company would pay the rest. In this example, your out-of-pocket cost for this accident would be $2,500.

On the other hand, er…wrist…consider an HSA-based plan with a $1,500 deductible. That means you have to pay $1,500 out of your own pocket before your insurance kicks in.

Yes, $1,500 is a lot of money, but this is where having a health savings account will help you cover the cost of your medical expenses and help reach your deductible. Remember, that you and your employer saved $1,000 a year by going to the HSA based plan. If this money is deposited into your HSA, you have $1,000 a year to pay for medical expenses.

So now, you have $1,000 to help you reach your deductible, and you need $500 to reach your deductible. Like the co-pay plan, you still have co-insurance, so you will need to pay 20% of the remaining $8,500 or $1,700 or a total of $2,200 ($500 to reach your deductible that wasn’t in your HSA, plus the $1,700.)

So when you compare the co-pay plan with the HSA based plan in this example, in the co-pay plan, your out-of-pocket costs would be $2,500, but in the HSA based plan, your out of pocket costs were $2,200.

Remember, your HSA is a health savings account that you can contribute money to and use for medical expenses tax-free and these funds are yours even if you switch jobs. Your HSA spending may apply to your deductible and coinsurance if those expenses are covered by the plan, which in this case, a broken wrist! Your HSA can help you pay for qualified medical expenses like eyeglasses and dental work, but remember, these expenses will not apply to your deductible.

On a traditional co-pay or an HSA-based plan, your worst-case scenario of reaching your out of pocket maximum could be very similar. The big advantage for an HSA based plan is that:

- you paid less money for your health insurance each month,

- that savings is your money, and

- whatever you don’t spend rolls over year after year and is there when you need it.

It’s truly a compelling, game-changing concept.

For some perspective, did you know that in any given year about 70% of people will spend $700 or less on medical care? If you have an HSA based plan, this is good news because, since HSA funds roll over every year, you get to keep whatever you don’t spend, ultimately encouraging smart medical spending.

HSA funds can also be invested for tax-free growth and investment earnings creating a future financial asset as well as a rainy-day fund for medical services. Over time, you could build up substantial savings in your HSA, then, when you turn 65 years old, your HSA acts like a 401(k) and can be used as another retirement account. In summary, the best thing about an HSA based plan is that it gives you a strategy to save up pre-taxed money to pay for large, unexpected medical expenses.

As you can see, over time you could have more money in your HSA than your deductible, which means you would not have to pay out-of-pocket to meet your deductible.

Let’s review:

Both plans:

- Provide valuable insurance coverage

- Cover preventive services at 100%

Co-pay plans:

- Co-pay – pay fixed amount for medical care

- Lower deductible – insurance kicks in quicker

- Higher monthly premiums

Copay Insurance Plans

HSA-based plans:

- Health Savings Account (HSA) benefit

- Higher deductible

- Lower monthly premiums

- Tax savings

All Copay Health Insurance Plans

We hope this helps you understand how the two plans work and how an HSA based plan could provide you with a smarter strategy to pay for healthcare in the future.